The ongoing slowdown of the global economy continues to put a downward pressure on commodity markets. Although global inflation has started to moderate, price pressures remain at historically high levels. The combination of high prices and rising borrowing costs constrain consumers and businesses. Subdued consumer spending on goods and services and sluggish manufacturing activity, accompanied by weaker B2B demand and capital investment growth, are set to reduce demand for energy, metal and food commodities, and cap price growth this year.

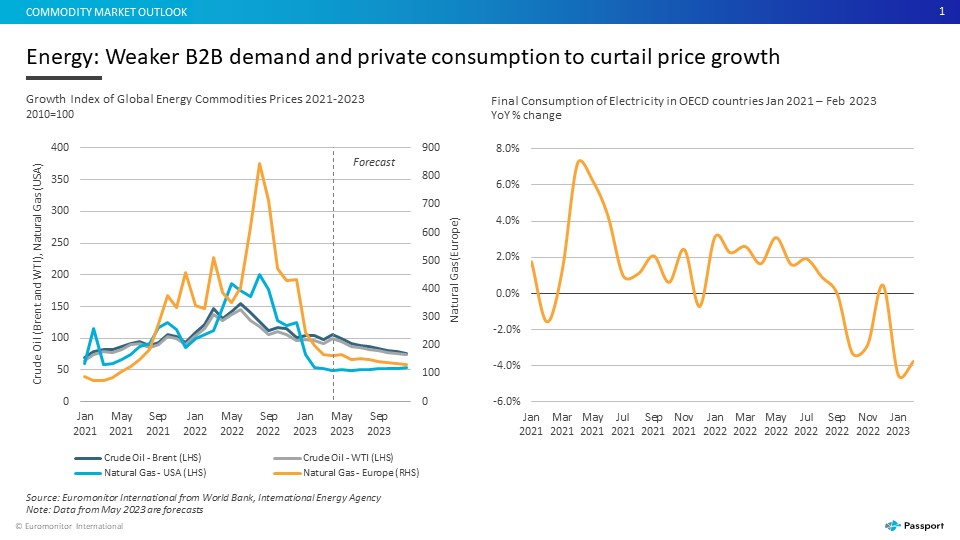

Demand for energy to remain subdued as global economy slows

Energy prices fell by over 20% in Q1 2023 year-on-year, as the global economic slowdown, energy conservation and favourable weather helped to reduce energy demand. Decline was particularly pronounced in natural gas prices, which were down by half year-on-year during the first months of the year.

In 2023, energy prices are forecast to remain lower than a year before. Demand reduction efforts and a strong boost in energy efficiency and renewables will help to limit demand for fossil fuels and alleviate energy market pressures. In fact, global investments in clean energy technologies surged by 19% year-on-year reaching a record high of USD1.3 trillion over 2022, with renewables, energy efficiency and transport electrification ahead of other technologies, as reported by the International Renewable Energy Agency (IRENA). Moreover, macroeconomic headwinds will weigh on global energy consumption, with recession concerns intensifying across advanced economies and China’s post-COVID-19 recovery losing momentum.

On the supply side, rapid expansion of liquified natural gas (LNG) capacities has helped to mitigate pressures in natural gas markets. For example, the LNG import capacity in the EU and the UK is expected to surge by 34% by 2024 from 2021 levels, according to the US Energy Information Administration (EIA), reducing the region’s exposure to future gas supply and price shocks. However, higher-than-expected competition for LNG from Asian economies and more challenging gas storage replenishment ahead of next winter in Europe pose upward risks.

The anticipated supply constraints in oil markets could put upward pressure on crude oil prices. For example, output declines related to export pipeline outage in Iraq, wildfires in Canada, protests in Nigeria and maintenance works in Brazil, as well as the agreed OPEC+ production cuts (at 3.66 million barrels per day, as of April 2023), may tighten the energy market in 2023.

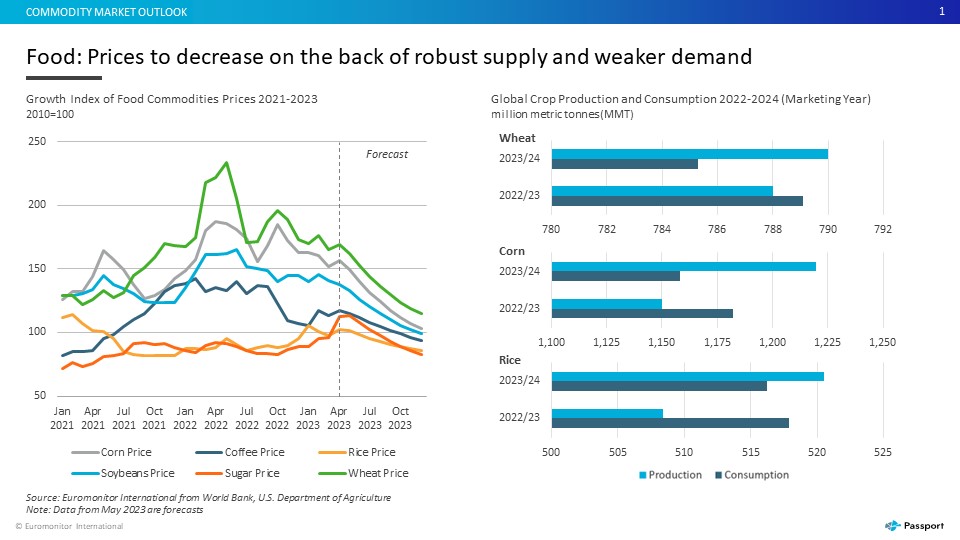

Agrifood prices to decline amid better supply projections and slowing demand

Solid harvests globally and the extension of the Black Sea grain initiative, which enables transportation of food exports from key Ukrainian ports, have helped to support sufficient supply, easing price pressures.

Prices of agrifood commodities decreased by 5.6% year-on-year in Q1 2023, dragged by falling prices of grains and oils

Source: Euromonitor International

Over 2023, grain and oilseed prices are expected to decline, led by corn, wheat, soybeans and palm oil, thanks to robust harvests in Brazil, Australia, Canada, Russia and the US. On the other hand, price projections for rice, sugar and fruits are tilted to the upside due to the lower comparison base last year, as well as rising consumption of rice, a tighter market for sugar, and fruit output risks related to extreme drought and heatwaves in Europe.

While the extension of the Black Sea grain deal until July 2023 has provided temporary relief, future renegotiations remain uncertain, posing potential supply limitations later in the year. Ukraine’s lower output due to the ongoing war, as well as temporary bans on Ukrainian agrifood imports (introduced by some European countries as oversupply of cheaper agricultural products from Ukraine has undermined the competitiveness of local farmers), add extra risks to the global food supply.

From the demand side, the persisting inflation and rising borrowing costs are expected to further subdue household spending across the globe. While China has seen a rebound in retail sales and foodservice over Q1 2023, the recovery in domestic consumption has been, thus far, slower than expected.

Falling fuel and fertiliser prices have provided some relief for farmers, and improving affordability of inputs could help increase agrifood output. Yet, average fertiliser prices are still roughly two times higher than pre-pandemic levels. Persistently elevated costs, coupled with rising interest rates, put extra pressure on farming margins, leading to higher food prices.

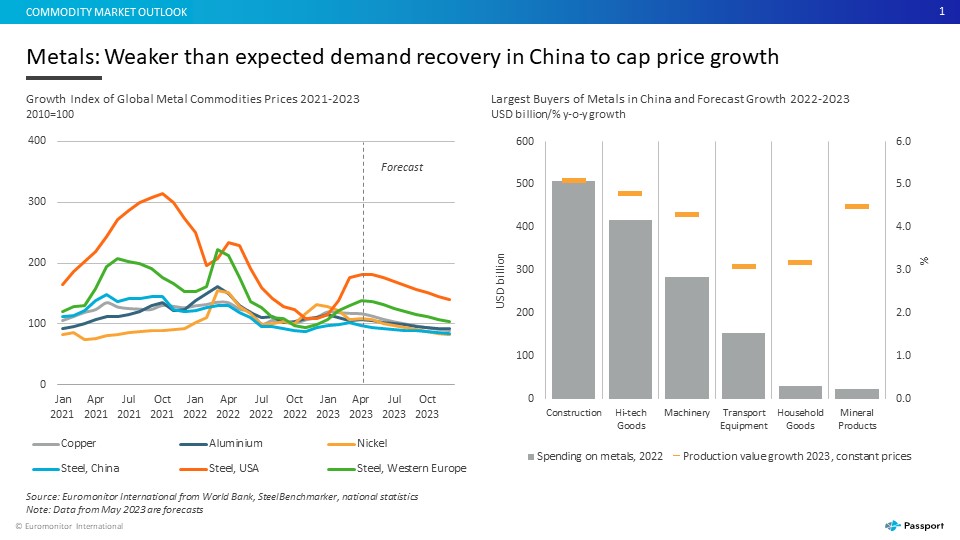

Prices of metals ease following weaker-than-expected demand recovery in China

The prices of key base metals declined by 16.6% in Q1 2023 due to weaker global B2B demand and increased supply of metals. Slower-than-anticipated demand rebound in China further contributed to the lower prices of industrial metals. Despite China’s economic expansion in Q1 2023, the construction sector faced challenges, with real estate development investments down by 4.0% year-on-year from January to May. As the construction industry consumed 23% of metals in China in 2022, weaker growth negatively impacted the demand for steel, aluminium and copper. On the other hand, higher production volumes in the automotive sector lifted demand for lightweight metals.

Additionally, increased metal supply contributed to lower prices of metals. The largest miners such as Rio Tinto, Vale, and Glencore reported increased shipments of non-ferrous metals in Q1 2023 and contributed to the moderation of prices. Higher production output of nickel in Indonesia and the lifting of the nickel export ban imposed by the Indonesian government in 2020 are also projected to limit metal prices in 2023.

The stability of metal prices in 2023 will depend on the growth of China’s manufacturing sector and the stability of metal ore supply. China’s economic recovery remains fragile, and the duration of its accelerated growth remains uncertain. A stronger recovery in the manufacturing sector in the second half of 2023 could drive up demand for metals and accelerate price growth.

Potential supply disruptions in Latin American mines could contribute to price volatility in 2023, especially in the copper and lithium markets. For example, political protests in Peru and Chile led to temporary production scale-backs of metals in Q1 2023. Furthermore, the potential elimination of Russia from export markets may cause disruptions in metal supply, primarily affecting the automotive, aerospace, and renewable energy sectors.

While commodity prices have eased from last year’s highs, they persist at historically elevated levels. This continues to present a heightened cost burden for businesses and dampen consumer purchasing power and affordability.

Learn more about developments in global commodities markets in our report, Global Trends in Commodities Market, to identify key risks and opportunities related to changes in global commodity supply and prices. To learn more about the global economic outlook and top risks, download our new white paper, Global Economic Forecasts: Q2 2023.